The Risk of Holding Cash

Cash has its place in any financial plan. However, holding too much cash or cash-like investments like a CD or a Money Market account can be one of the most overlooked risks when it comes to long-term planning.

Inflation creates permanent loss

Traditional wisdom says if you want to preserve your dollars, keep them as cash. Yes, this level of caution can help reduce short-term volatility or loss of capital. Unfortunately, unbeknownst to many investors, cash is not as risk-free as it seems. Holding too much cash long-term can come at a high price.

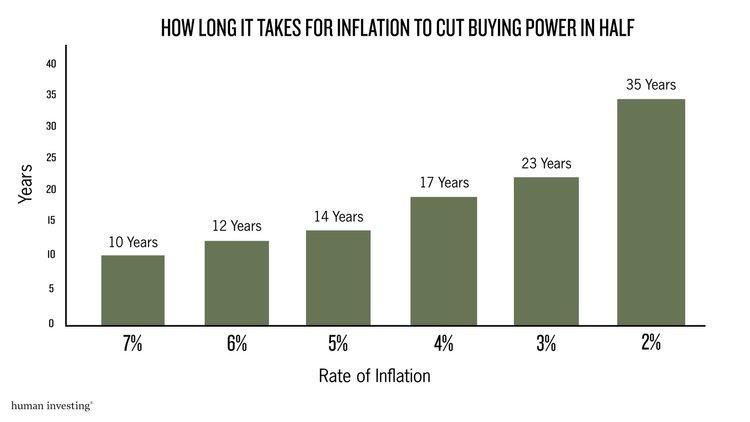

Inflation is defined by the Federal Reserve as "the increase in the prices of goods and services over time.”[1] For investors, inflation is a silent killer that, if unchecked, can permanently deteriorate their purchasing power. To stress this, see how quickly your money can be cut in half based on different inflation rates.

Table 1

Source: Ycharts

Build a diversified plan

Inflation requires investors to think long-term. Balancing temporary risks with combating inflation is an essential element of building a successful financial plan.

Long-term investors who want to combat rising costs due to inflation should look to build a diversified investment strategy with an appropriate amount of stocks. While the stock market entails short-term volatility, it has never experienced a total and permanent loss. In fact, stocks have done just the opposite.

Table 2

This graph is for illustrative purposes only. Past performance is no guarantee of future results. Data sources: Health care costs, CMS.gov; Portfolio returns, CFA Institute (SBBI®)

When should I hold cash?

This is not to say someone ought to avoid holding cash altogether. Strategic cash cushions do have a significant place in a financial plan when considering both short-term and long-term financial decisions (see the barbell approach). There is no one size fits all plan. The amount someone should keep on hand should correspond with their living expenses, instability of income, stage of life, risk tolerance, etc. This amount is typically 3 to 12 months of living expenses. However, the permanent risk associated with holding too much should be evaluated, and if possible, mitigated. This starts with a deliberate and personalized plan concerning how much to hold and where to keep it.

Decisions around cash are just as psychological as they are financial. For this reason, it can be helpful to enlist the help of a trusted partner like Human Investing who has your best interest in mind.

We are here to help! To schedule a call with one of our advisors to build a plan around financial plan schedule a courtesy call/meeting below or call us at 503.905.3108.

Sources

[1] Federal Reserve (2016). What is inflation and how does the Federal Reserve evaluate changes in the rate of inflation?

[2] Inflation Data source from 1/1/1926-12/31/2021: Ycharts.

[3] U.S. Centers for Medicare & Medicaid Services. “Projected | CMS.”

[4] CFA Institute (2021). Stocks, Bonds, Bills, and Inflation (SSBI®) Data.